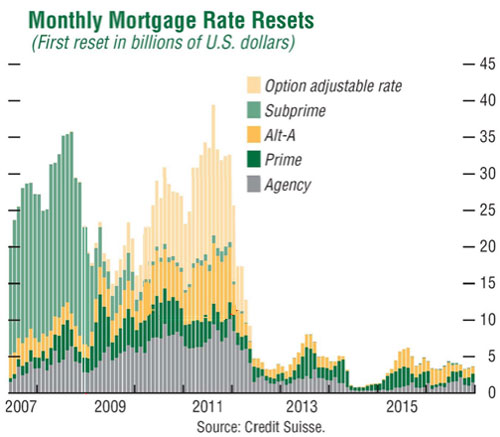

Global Trade Recession Indicators Redline – It’s Going To Hurt

As mentioned in an early post, there are no clear signals that the global economy is skidding to a violent halt. This can only spell additional trouble for activist governments intent on conjuring up enough money to bluff the world wide credit implosion into submission. For the past two decades, the most prosperous nations on […]

Another perspective on the continuing crisis

There will come soft rains and the smell of the ground, And swallows circling with their shimmering sound; And frogs in the pools singing at night, And wild plum trees in tremulous white; Robins will wear their feathery fire, Whistling their whims on a low fence-wire; And not one will know of the war, not […]

Read More