Debtzilla Laughs At $700 Billion…

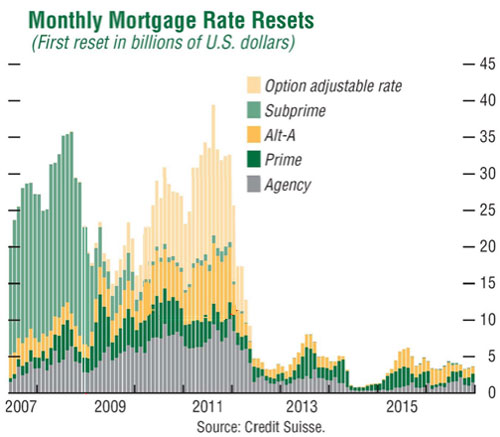

I know there are plenty of folks (somewhere) who think that throwing $700 Billion down a deep debt hole was going to fix things. Let me help you out. Consider the graph below from Credit Suisse What this shows is that the first rate resets for the Subprime loans has mostly passed. So people who […]

The Gods of the Copybook Headings

Jerry Pournelle over at his blog has linked to the Rudyard Kipling classic. Written nearly 90 years ago, it is remarkably apt right now, as our financial system threatens to melt down over human greed and stupidity: As I pass through my incarnations in every age and race, I make my proper prostrations to the […]

Read More