The Blessing Under The Ashes

Photo credit SD Union Tribune The fires in San Diego County are still burning, but the worst has probably passed. At last count over 1,000 homes had burned in the fire, and word from the Union Tribune is that the first permit to rebuild was filed this morning. Prior to the fires, one of the […]

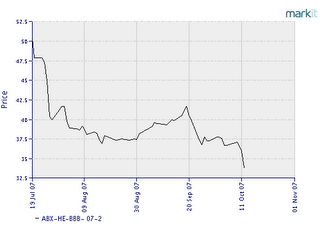

Inflation – American Consumers Fighting Back

If you believe some of the negative financial press the American masses are a fickle mob of spendthrifts that mindlessly blow everything they have and then some without a care. In contrast to that, I offer a story from the Wall Street Journal: Food Makers Struggle To Pass On High Costs High commodity prices have […]

Read More