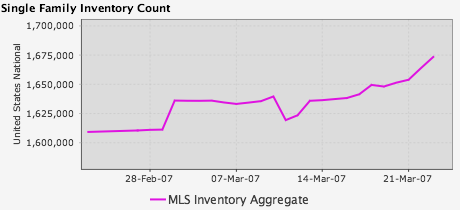

Nation Wide Real Estate Inventory Rocketing Higher

Last year marked the start of the housing downturn in several markets. The clearest indicator was the ballooning levels of existing home inventory for sale, and the fact that these homes largely stayed on the market until Thanksgiving without moving in an appreciable way. In some markets, at the sales flow rate at the time, […]